Correct!

Keeping the plant open makes a certain kind of business logic, but over the next five years you’ll go on to spend (and lose) somewhere in the region of $100 million in unsuccessful ventures drilling in Egypt, half that again in Equatorial Guinea and $30 million in Gabon. Despite this, you’ll all make plans to spend $650 million on prospecting South African waters (with no results to this day)[3][4]. In hindsight, perhaps sticking to fossil fuels wasn’t the best bet. Over the next 18 years the cost of renewable energy and battery storage will drop by 90% or more - but who could have predicted that?

Learn more

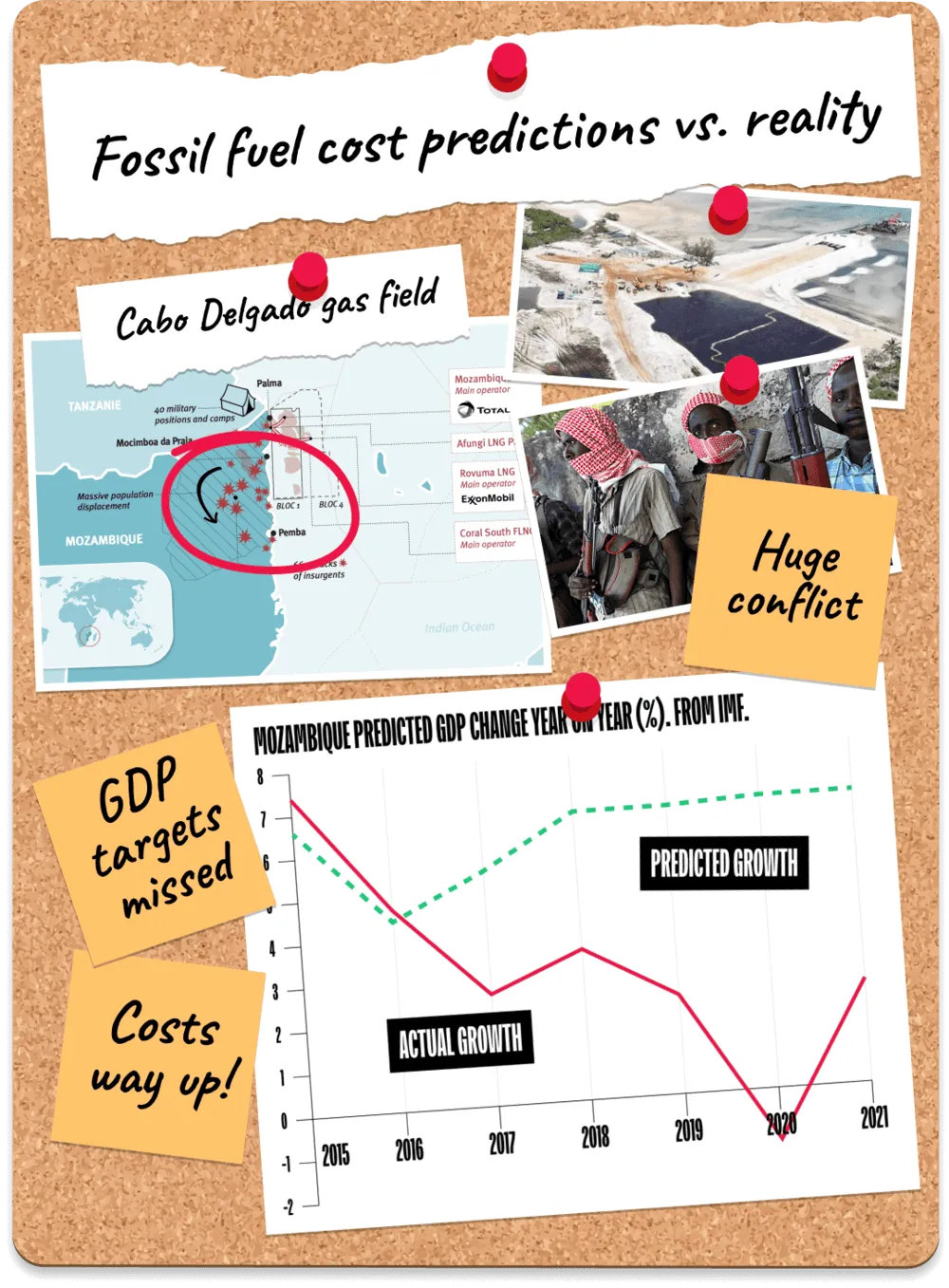

Who could predict it? Well, the issue of hidden costs and overspends in fossil fuel extraction - and who pays for it - is well understood globally. Fossil fuel firms have always received lots of hidden subsidies which make their products seem more cost effective than alternatives, although in the long term they are anything but. On paper, the return on investment always looks good, but fails to deliver. Taxpayers often swallow the losses, investment costs or interest on loans for unsuccessful or disappointing prospecting, while shareholders split the gains. Take our neighbour, Mozambique. Loans were taken out to cover the vast cost of developing the Cabo Delgado gasfield on the prediction that GDP growth between 2014 and 2021 would be around 36%. The reality is that that growth was closer to 8%[8]. What’s more the project has sparked conflict, violence, environmental impact and increased corruption. All hidden costs which are left to residents of Mozambique and its neighbours to sort out[8].

References

- 3

- 4

- 5

- 6

- 7

- 8