Green Connection's

Did you know?

Countries which rely on fossil fuel exports to sustain their economies are vulnerable to unique challenges which are often beyond their control. These often make their investments in the sector uneconomic in the long run. For example, governments may be willing to underwrite loans to gain foreign investment and secure jobs today, but end up with infrastructure producing oil, gas and coal products based on outdated technology. Not only that, but they will have missed opportunities to invest in renewables. Global Energy Watch estimates that up to $245 billion of investments in gas alone could end up as “stranded assets”[9][10][11], and that “Emerging petrostates are setting up their industries at the worst possible time“. Even worse, the rush to secure natural gas following the invasion of Ukraine and introduction of sanctions against Russia has led to an oversupply in the global market and a drop in market prices. By effectively subsidising the production of fossil fuels, governments are increasing the chances that they will end up in a debt trap. The spot price of gas in mid-2024 was 80% less than it was two years before[12].

Charts

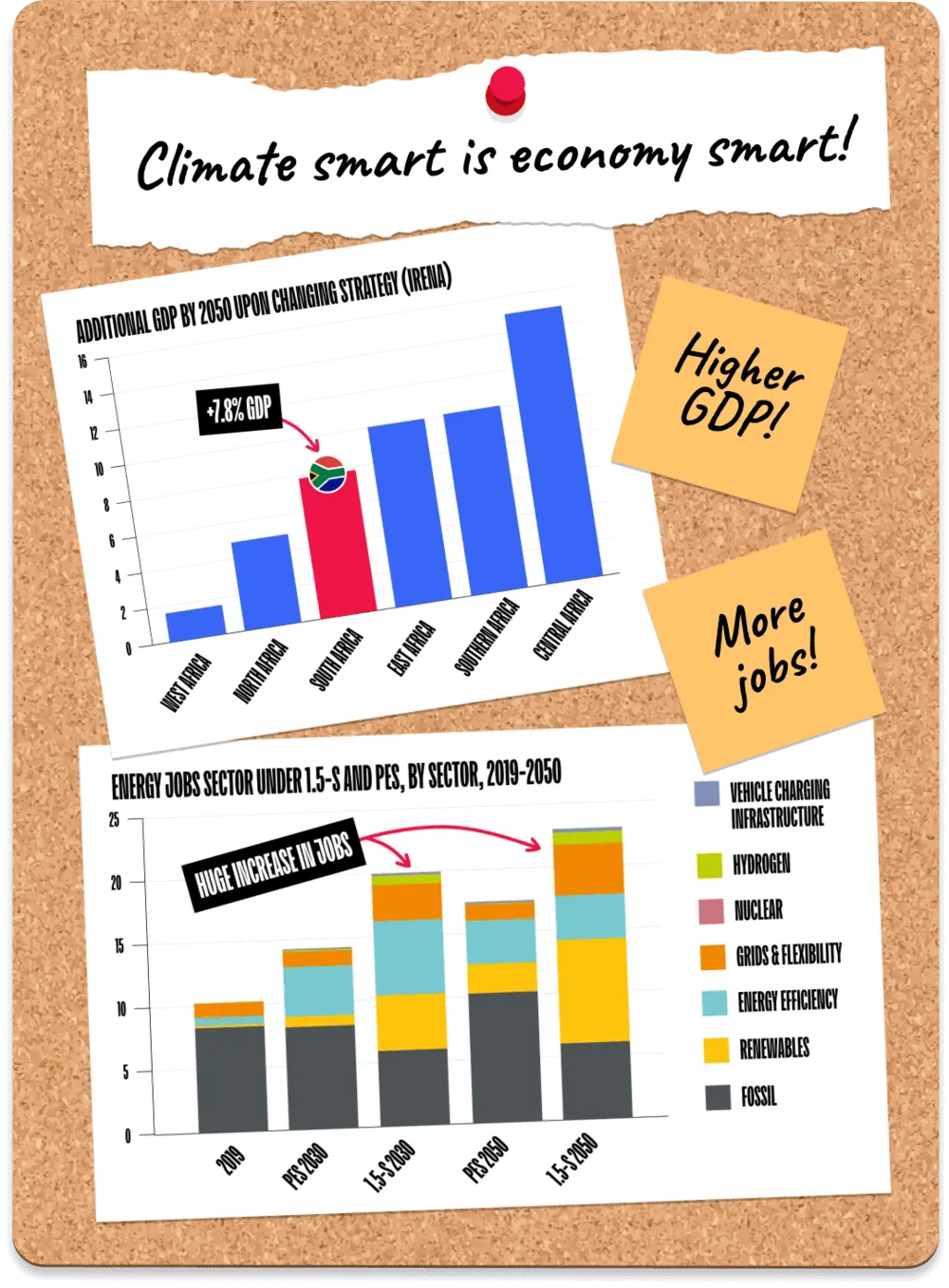

The International Renewable Energy Agency (IRENA) estimates that a strategy of investing in renewable energy, energy efficiency and related fields such as climate smart agriculture, rather than pursuing current energy goals, could result in significantly more jobs and GDP growth[13].

Next scenario

Next scenarioReferences

- 9The scramble for Africa’s gas,

https://globalenergymonitor.org/report/scramble-for-africa-gas-poses-us245-billion-stranded-asset-risk/ - 10The debt-fossil fuel trap,

https://debtjustice.org.uk/wp-content/uploads/2023/08/Debt-fossil-fuel-trap-report-2023.pdf - 11The rights and wrongs of investing in natural gas,

https://www.economist.com/finance-and-economics/2022/06/23/the-rights-and-wrongs-of-investing-in-natural-gas - 12

- 13Renewable energy market analysis (IRENA and African Development Bank),

https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Market_Africa_2022.pdf